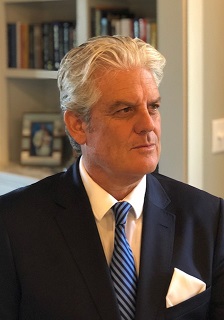

From the CEO – March 2021

Dear Clients,

As I suggested several months ago in a previous client letter, it wouldn’t be too long before inflationary concerns took hold in much of the public and professional discourse given rising treasury yields, questionable equity valuations, and the trajectory of various asset classes, from the USD to emerging market debt. Now, with an increasing number of international firms cautioning that supply-chain blockages, higher raw material and other input costs are beginning to be felt in their operations, the debate will now move beyond the confines of the investor class.

The discussion about inflation and its wider effects – at least in developed markets – has been dormant for quite some time, and I can only recall open discussions about price pressures during the late 1980s and early 1990s. That was some time ago, so for many market participants – and those concerned about the implications of rising costs on political risk – this is a new chapter of sorts, interestingly linked to the post-COVID-19 world.

One of the volumes that is currently on the bookshelf is a nice piece recently written by Dr Mark Mobius, the former executive chairman of Templeton Emerging Markets Group, and now head of Mobius Capital. As most know, Mobius has written a number of useful books on various topics affecting the emerging market assets class, and his most recent piece, The Inflation Myth, contains some interesting insights for those that wish to (re)acquaint themselves with this phenomenon. I’ll only touch on a few aspects of the book that I think are particularly instructive to today’s environment so that inflation might be put into a larger context going forward.

Chief among Mobius’ first tasks is to lay out the history of inflation, from the travels of Marco Polo and the Tang Dynasty’s debasement of Jiaozi (aka certificate of exchange) given its funding needs, to the Roman Empire’s degradation of its currency, beginning with Nero’s efforts to reduce the silver content of the coins in circulation. Dr Mobius also devotes time to explaining hyperinflation, the connection between the money supply and inflation, and various exercises in measuring inflation. This latter chapter is most interesting since the quantification of price movements are complicated by the ability to access relevant data, the oftentimes difference between rural and urban inflation (Mobius uses China’s transition to a market economy to illustrate the point), and what inflation numbers tend not to capture.

Also useful is the chapter on how governments manipulate the numbers and how various explanatory models tend not to do the best job in explaining the actions of government towards inflation, such as the Phillips Curve’s postulate of the positive relationship between economic growth, inflation and lower unemployment which fell apart in the ‘70s during the period of ‘stagflation.’

The book offers some concluding thoughts on inflation: indices are constantly changing in their composition as stats people try to ensure they reflect changes in consumption, which makes understanding price changes difficult over time; inflation has not occurred in isolation, since, for example, wages and incomes have sometimes raced outpaced inflation numbers; and relative to incomes, the cost of many items have fallen and continue to decline (which is particularly the case with electronic goods).

Taken together, Dr Mobius’ book provides us with an improved understanding of the world of inflation and with it the ability to be better positioned to profit in a way that is not captured by the ‘talking heads’ on television or the inflammatory headlines of various online news sources.

Turning to our ratings for the month, a number of countries stand out. In the Americas, protests in Paraguay continue over the handling of the vaccine rollout amidst calls for the impeachment of President Benítez. In Haiti, the country’s ‘Very High’ political and composite risk rating remains, as there is now pressure on the US to drop its support for Haiti’s president’s plan to hold a referendum and elections at a time of rising violence and kidnappings.

Over in Western Europe, Chancellor Merkel’s approval rating resumes its decline, and there is now the real prospect of the CDU not forming part of the new government. Germany’s jobless rate hovers around 6% and consumer confidence remains low.

A similarly dismal situation remains in the Czech Republic – the country with the highest COVID-19 infection rate globally – as the Babis government is stalled at 25% support in the polls with a parliamentary vote set for October.

In Eastern Europe, corruption, a politicized judiciary (inter alia) are jeopardizing Albania’s chances of joining the EU anytime soon. Executive-legislative relations continue to be caustic, and the press is becoming less free. The opposition parties have united recently in an effort to defeat Prime Minister Rama in the April polls.

In Bulgaria, the ruling GERB has extended its lead over the socialists heading to the April vote. Anti-lockdown protests continue but should recede as the country’s vaccine rollout matures. Consumer confidence levels are rising sharply.

In Asia, Indonesia’s consumer confidence level is up, and growth is penciled-in at 4% this year. Pockets of COVID-19 cases continue to appear as the Chinese vaccine has been approved for use. The rollout of the vaccine has helped President Joko’s numbers. The poverty rate remains at 8% and the jobless rate sits at 10%. There is little expectation that these numbers will improve even as the economy expands this year.

Prospects for stability in Myanmar look bleak at the moment: the protests against the military junta/coup continue with over 500 reportedly killed in the violence. The economy is effectively shutting down as large-scale strikes occur and as refugees from the turmoil move into Thailand.

In Africa, Gabon’s rollout of the Chinese brew has begun, and the government says it will meet its bond repayment obligations this year largely through reprofiling some liabilities. And in Niger, president-elect Bazoum has made clear the potential for continued violence in the aftermath of recent voting. The Jihadist threat will continue in Niger.

Finally, in the Middle East, subsides in Lebanon as being cut as cash runs low, with the prime minister essentially looking for a way out of leading the country. Lebanon has moved now into the “Very High” political risk category.

And in Libya, the transitional government has assumed the reins of power in Tripoli, leading to elections later this year. Unfortunately, social conditions will likely not improve anytime soon, and the poverty rate continues at 33%.

Copies are now available of our new book Quid Periculum? Measuring & Managing Political Risk in the Age of Uncertainty, co-edited and co-authored by me and Peter Marber (Harvard/Aperture Investors). The book includes such diverse topics as risk forecasting techniques, reliability measures, the impact of political risk on asset prices and sovereign debt workouts. Also featured is a special roundtable discussion by some of the world’s leading voices in the field on the future of political risk, who combine to address some of the challenges presented by globalization and COVID-19. For more information and to reserve a copy of the book, please contact Louis Carroll, PRS’ Director of Business Development, at lcarroll@prsgroup.com.

March was another excellent month for new and returning clients, ranging from some of the world’s top universities to the largest institutional investors throughout the US, Europe, the UK, and the Middle East and Asia. We are also pleased to be working with the Finance Ministry of the Government of Uzbekistan in an effort to bring that country into the ICRG fold and have it ranked alongside the 140 countries contained in the index.

Not only is ICRG being used by some of the world’s largest technology firms, but the data are now being incorporated increasingly into the artificial intelligence/machine learning space, with an emphasis on ESG data! On this score, we are especially pleased that our data are being used by an increasing number of institutional investors as the empirical connection between our select risk indicators and various asset classes become more pronounced and tradable. For decades, PRS’ reach has been global, offering the absolute best quant-driven and independently back-tested data available anywhere.

We are also delighted to mention that PRS will be completing its re-branding process this year which will include a new look that pays homage to our 40+ year history, along with various events that helped lay the foundation for our work – some of which extend to the introduction of the Hindu Arabic number system at the outset of the Italian Renaissance and a now famous exchange of letters between Blaise Pascal and Pierre de Fermat in 1654. As part of the new-look PRS, we will continue to unveil new products which include data bundles of particular importance to the academic world and more timely country risk forecasts available online.

We continue our discussions with the data analytics departments from several of our academic clients in the US, with the aim of providing the most comprehensive, AI-generated and back-tested data on geopolitical risk available anywhere. The effort pairs our internal work under the rubric of the PRS Artificial Intelligence Initiative, which we will soon make available to select clients. Stay tuned for more details.

PRS Private Client Advantage, which offers new and existing clients a greater diversity of data offerings and regular updates, consultations, bundled products, and more, is – judging from client demand – even more essential. Contact us for details. With the fluidity of the ratings, this benefit for clients is especially important.

Our ICRG political risk scoring changes were very robust in March, affecting some 77 countries (of 140) and over 100 individual political risk metrics!!

ICRG and related PRS data continue to be the gold standard of all geopolitical risk data among the scholarly and research communities. This month I had a chance to look at the numerous working papers released by the National Bureau of Economic Research (NBER), and found a wide range of studies that used our ICRG data to shed light on, inter alia, financial openness and productivity, the determinants of corruption, the relatively small size of Asian bond markets, and why capital often doesn’t flow from rich countries to poorer ones. (see www.nber.org)

Thanks for your continued support, and please contact us if we can be of any assistance.

Chief Executive

PRS INSIGHTS

Moving beyond current opinions, a seasoned look into the most pressing issues affecting geopolitical risk today.

EXPLORE INSIGHTS SUBSCRIBE TO INSIGHTS