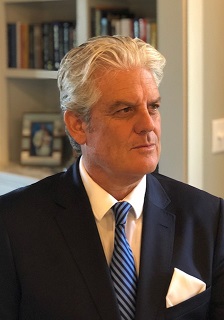

From the CEO – July 2020

Dear Clients,

One of the benefits of having the longest running and independently back-tested geopolitical risk series globally is that it lends itself to a range of applications and uses, from asset trading and portfolio management, to risk mitigation stratagems, bond and firm valuation, to uncovering insights into various economic and political phenomena.

The first foray into uncovering a fuller appreciation of the depth of the data was in the early 1990s, when Professor Campbell Harvey (Duke, Fuqua School of Business) and others looked at our data series and were able to ascertain relationships between ICRG risk metrics and returns in emerging market equities. The study was really the first of kind and was later covered in Barron’s, which mentioned quite clearly the data’s ‘predictive qualities.’ It was the beginning of a longstanding relationship between the academic world and PRS, which allowed us to enter the field of artificial intelligence and machine learning several years ago.

Through a partnership with ToggleAI (USA/UK) (www.toggle.ai), and backed by some of the largest institutional investors and trading platforms globally, the ICRG composite and political risk scores are subjected to a series of machine learning applications to provide investible actions across asset classes and across countries.

The checklist used to determine the value of the action range from whether it has been triggered across different business cycles; whether it is notable relative to history and occurs at regular intervals; whether it has a high historical hit rate and accuracy (out of sample); and whether it has attractive risk-reward characteristics.

As a second generation effort we are now entering early-stage discussions with a number of our academic clientele in the US to harness the data in a way that is most useful for university and think-tank groups; one that will provide insights into correlations between risk metrics, conditional movements between countries, and what might be termed casual relationships between ICRG risk metrics and such concerns as future growth and inflation rates, debt-servicing potential and likelihood of sovereign default, to name a few. As many of our clients and friends already know, much of the latter appears regularly in the IMF’s Working Papers series, which uses the ICRG.

Looking at geopolitical risk this month, overall levels have come down considerably since the C19-related closures took effect in March. Driven largely by successful ‘openings’ in Europe and select Asian and Africa countries, capital has shifted mainly to Europe, against the backdrop of a recently-passed stimulus bill and a stronger euro against the greenback. Indeed, most currencies gained against the USD over the past month.

However, concerns about rising levels of autocracy in Hungary and Poland continue to be reflected in our risk models. Generally, such political leanings don’t necessarily pose an issue for capital (depending on their ideological bend they can be advantageous) but over time they can lead to various spillover effects, ranging from social unrest, lower lending spreads and multilateral support, and the negative attention from NGOs and supranational organizations. All of these potential risks – and metrics used to assess political and country risk – are captured in our ratings and forecasts.

The situation in the US is quite different. Risk levels began to deteriorate in January. C19-related growth impediments, protests, election uncertainty, delayed stimulus measures, and a loss in the purchasing power of the USD have all had their effect on the country’s profile.

Looking at some of the risk highlights in July, several are notable. In the Americas, Guyana still has no official winner of the disputed election. Combined with simmering and longstanding racial tensions, the uncertainty has disrupted plans for Exxon’s offshore efforts.

Over in Western Europe, Poland’s President Duda captured a narrow victory in that nation’s July vote with 51.3%. But the opposition declared electoral fraud, although Poland’s courts have said they won’t seek to overturn the result. In the UK, Prime Minister Johnson’s approval rating has slipped a tad, but the Tories remain the favored party over Labour. Consumer and business confidence have improved, too.

In Africa, peace talks in Cameroon have begun with the country’s main separatist group(s) despite a rash of killings recently. The economy is set to contract by 2% this year with a fiscal deficit of some 4.3% of GDP. The situation in Ethiopia isn’t much better, as the murder of a popular musician has fueled unrest and there remains considerable unease (and a constitutional crisis) over the postponed election. PRS is wary of the foreign investors’ ability to convert and transfer capital as Ethiopia’s reserves are now quite low, providing minimal import cover.

In Asia, China’s Q2 growth numbers turned positive, inserting some good news for countries looking to turn the corner economically after the lockdown. Yet consumer demand remains relatively weak, and the authorities are expected to provide additional stimulus for infrastructure development and consumer spending. For its part Mongolia elected a new parliament in July, as the multi-member voting system has returned.

In Eastern Europe, consumer confidence in the Ukraine has fallen along with President Zelensky’s approval rating. On the upside, the cease-fire with Russia-backed separatists has begun and the initial outlook for its success seems quite favorable at present.

In the Middle East, foreign exchange reserves and the money supply in Saudi Arabia are both up, although the government is planning on continuing to look at selling-off state assets to shore up the country’s fiscal accounts. Consumer confidence is steady although we see some impediments to higher levels in the short-term given the forthcoming tax increases. And in Libya, the civil war there looks to intensify as Egypt and Turkey (re)position themselves. The country’s economic prospects are quite dismal, and the currency continues its downward trend against the USD and the EUR.

July was again a very impressive month for new and returning clients. On the former, we would like to welcome US Naval Academy, Cairo University, Cornell University, Compass Lexecon, and Aksaray University, to name a few. On the latter, we want to welcome back Blackrock, RobecoSAM AG, Bloomberg, SOAS University of London, Rice University, University of Warwick, Hong Kong Polytech University, Stern School of Business, and many others. Thank you so much for your continued support for the best quant-driven geopolitical risk rating and forecasting data anywhere!

The C-19 pandemic has kept us busy with all the changes to economic forecasts and various political configurations – and likely risk events – we have had to incorporate into our models as this very unique future unfolds before us. Our client base has been especially attentive to the ICRG changes, and we’re happy to see such a devoted base and happy to accommodate the myriad questions.

I was able to return to the academic fold – as it were – in July after being invited by Professor Steven Johnson of American University School of International Service in DC to give a talk to his graduate students on how political risk has evolved since the Asian financial crisis and what types of opportunities exist for those interested in a career in the field. The question and answer period was especially enlightening for me. Thanks to Professor Johnson for his gracious invitation.

The ICRG data series continues to be the gold standard among the world’s leading academic researchers and multilateral organizations. Using our risk series in part – and delving into a topic of particular relevance in the C19 world – a recent addition to the IMF’s Working Paper series looked at the role of monetary policy frameworks in the propagation of aggregate shocks affecting low-income countries. Targeting inflation/monetary aggregates versus maintaining rigid nominal exchange rates does have an effect on real GDP growth. (https://lnkd.in/dUhWTCg)

In a related manner, ICRG data were used to help quantify the costs of conflict in terms of GDP per capita, private consumption, official trade and other items. (https://lnkd.in/dGdmF56)

All told, July’s political risk changes affected about 90 countries in the ICRG’s universe of 140 nations, modifying, in the process, over 130 individual metrics.

Chief Executive

PRS INSIGHTS

Moving beyond current opinions, a seasoned look into the most pressing issues affecting geopolitical risk today.

EXPLORE INSIGHTS SUBSCRIBE TO INSIGHTS